Portfolio Composition

DT Capital’s typical portfolio consists of listed and unlisted companies in the Greater China region, Southeast Asia, and Europe in the form of equity or equity-related securities and debt instruments. In order to control risk, DT Capital invests no more than 20% of its total assets in any single position, and holds no more than 30% of any company’s voting shares.

DT Capital invests in companies at different developmental stages (growth stage, maturity stage and pre-IPO stage).

Its portfolio includes (and is not limited to) the following industries:

Unlisted Debt Securities

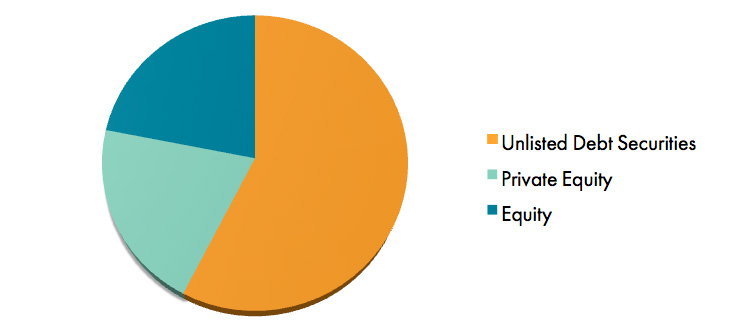

Currently, approximately HK$63 million of DT Capital’s portfolio is in unlisted debt securities. The companies involved are mainly in Greater China, and include the retail industry.

Private Equity

Currently, approximately HK$22 million of DT Capital’s portfolio is in unlisted shares. The companies involved are mainly in Greater China and Asia, and are in the retail and real estate industries.

Equity

As at December 31, 2015, approximately HK$24 million of DT Capital’s portfolio was in listed securities in Hong Kong. DT Capital also has investments in HK/PRC equity.